By Amy Chang

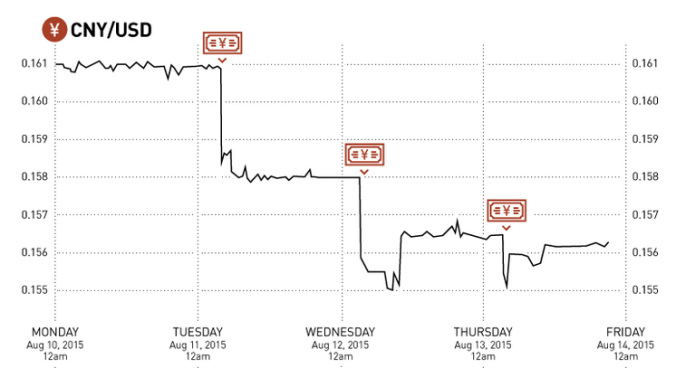

The Central Bank of China cut the daily reference rate of the yuan by 1.9 percent on August 11, and then twice more in the following two days, resulting in the largest currency devaluation in 20 years. The People’s Bank of China (PBoC) claims that the adjustment was a means of introducing market forces into the yuan, and President Xi has vowed to pursue no further devaluation. The currency reforms will likely aid China in its bid to have the yuan included in the IMF’s Special Drawing Rights basket, but also comes as Chinese exports and growth stall.

What are the implications for China’s development projects?

China has laid out a series of ambitious development projects that will require large scale investment, and could be impacted by falling foreign currency reserves. Foreign reserves plunged by $93.9 billion in August, and a further $43.3 billion in September as exports declined and Beijing took action to stabilize its stock markets and currency. Despite these decreases, China’s foreign currency reserves are still the world’s largest at approximately $3.3 trillion.

The IMF has indicated that $2.6 trillion would be an adequate total foreign currency reserve for China, and the recent outflows should not impede financing for China’s recent spate of outward investment. The New Silk Road is expected to require an investment of $40 billion, China will provide roughly $30 billion of the $100 billion capital base for the Asian Infrastructure Investment Bank, and the China Development Bank and Export-Import Bank each received an injection of $30 billion this spring. These projects represent significant investment, but should not pose a problem for the world’s second largest economy.

Will this adjustment hurt China’s trading partners?

The devaluation of the yuan will make Chinese exports cheaper internationally. Importers of heavy machinery, bulldozers, and electrical lines such as Ethiopia, Kenya, and Mozambique – all previously experiencing trade deficits due to the high costs of Chinese capital goods – will enjoy lower import costs. Indian firms specializing in the production of electronic goods import components from China, and can also expect a cheaper bill.

China is currently the number one trading partner for most African countries, and the devaluation makes it more expensive for China to import goods. Many African countries export raw materials and commodities to China, and prices for these goods were already falling amidst slowing global demand. Copper and crude oil prices both fell four percent to six-year lows, and Zambia’s copper mines have already started laying off workers. A devalued yuan will only contribute to falling Chinese demand for raw material imports.

How will the policy change affect global trade and investment patterns?

The yuan devaluation also means that Chinese exports will threaten to displace goods from emerging market competitors – particularly within the textiles, chemical products, and metals industry. India, already experiencing dwindling exports this year with the rising rupee, has seen export orders being shifted to its neighbor. Cheaper Chinese goods will likely impact other exporters, in Southeast Asia in particular.

With slowing global demand leading to iron ore and oil prices hitting record-lows before August, commodities exporters to China have seen their currencies weaken in the foreign exchange. Kazakhstan has seen its exports suffer a decrease of more than 40 percent since January, and the Kazakh tenge saw an accompanying fall in value. Capital outflows from emerging markets are expected to exceed inflows this year for the first time since 1988 due to such exchange rate volatility, pulling $540 billion from developing countries, according to the Institute of International Finance.

This economic slowdown is likely to worsen in upcoming months; this 3 percent devaluation in the yuan will lead to further market turmoil, as capital flows out of Chinese companies when investors start selling their short-US dollar/long-renminbi carry trades.

Amy Chang is a research intern with the Project on Prosperity and Development at CSIS.